Updated 13/09/2022

Since the Spring Statement was announced by Rishi Sunak in March 2022 there have been a lot of developments when it comes to the country’s finances and many changes have taken place – not only in regards the situation of the government itself.

On the 4th of August 2022 the Bank of England announced that the interest rates were rising to 1.75%, this is the largest hike the interest rate has seen in 27 years and has triggered warnings of a year-long recession.

Of course, we’ve all noticed that prices on everything from bread to olive oil has increased. The cost of a 750g container of Lurpak butter even made the news when it went up to more than 1p per gram.

Prior to making any announcement about the price cap, Ofgem has made a change to the timeline for the price cap going forward, and this is that changes will take place every 3 months rather than every 6.

According to Ofgem, the reasons for this are:

“To ensure that prices charged to bill-payers are a better reflection of current gas and electricity costs, allowing energy suppliers to better manage their risks, making for a more secure market helping to keep costs down for everyone.”

On the 26th of August, Ofgem announced the new price cap on electricity and gas that will affect household bills from October. There were many speculative articles in the press guesstimating how much the price cap would go up by. Originally it was predicted that the increase would be an estimated 32%, however the price cap has risen by 80%, taking it to £3,549 per year.

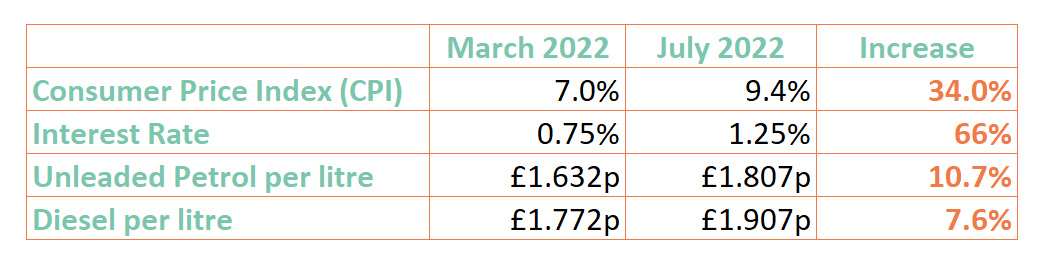

The table below shows the rate of inflation, interest rates, the Consumer Price Index, and the price of fuel as they stood at the end of July 2022. As you can see, they have all increased considerably since March 2022.

What help is available?

After a few months of political upheaval as the new Prime Minister was decided upon in Parliament, on the 8th of September, Liz Truss announced a new Energy Price Guarantee that is designed to help those who will be hit by the 80% rise in energy prices come October. This measure is a cap on the amount that can be charged by energy companies to their customers, the typical household will be billed a maximum of £2,500 per annum on dual fuel bills for the next 2 years, no matter what happens with the price cap announced by Ofgem.

To get a clearer idea of how much your monthly energy bills will be, MoneySavingExpert has created a calculator that looks at the costs by region.

In mid-May the Government announced further help would be made available to households to tackle the cost of rising energy bills, including:

- A one-off grant of £400 for 28 million households that will be paid in 6 instalments from October, directly to the energy companies

- A one-off £650 cost of living payment will be made in two instalments (one in July and the second in the autumn) to those receiving:

- Universal credit

- Income-based jobseeker’s allowance

- Income-related Employment Support Allowance

- Income Support

- Working Tax Credit

- Child Tax Credit

- Pension Credit

- A £300 cost of living payment for pensioners that will act as a top-up for the Winter Fuel Payment. This will be paid by Direct Debit in October/November this year

- In September a £150 payment will be made to those on disability payments if they receive:

- Disability Living Allowance

- Personal Independence Payment (PIP)

- Attendance Allowance

- Scottish Disability Benefits

- Armed Forces Independent Payment

- Constant Attendance Allowance

- War Pension Mobility Supplement

As always, if you aren’t sure that you’re claiming all the benefits that you’re entitled to, it’s vital that you check. According to AgeUK more than £2.4 billion in housing benefit and pension credit every year goes unclaimed.

The Government has a comprehensive calculator on their website that will help you discover if there is any further financial support available for you.

Where can I get advice?

If you have any questions about the help that is available to you; whether it’s financial concerns or general worries about the cost of living and how it is going to affect you and your way of life, then there are a number of organisations that could offer you support:

What can I do next?

As interest rates continue to rise, it’s possible moving home may be something you’re considering in order to reduce monthly costs such as energy bills, mortgage repayments, and general living expenses.

Exclusively for those aged 60 and over, a "Home for Life Plan" can provide a simple way for you to live rent-free and mortgage-free in your ideal home, that can be located anywhere in England or Wales, and on the market with any estate agent.

If you’re over 60 and are thinking about moving to help reduce your monthly outgoings, use this quick online calculator to find out how much your budget could be boosted by.

Have any questions about the Home for Life Plan and how it could help you? Get in touch with our team of experts for more information.

All figures above correct as at 13/09/2022

The Spring Statement has just been announced by the Chancellor of the Exchequer, one that was meant to help tackle the issue of the dramatic cost of living increases which have come about due to multiple events that have occurred over the last few years.

Brexit, the Covid pandemic, and most recently the events in Ukraine have dealt a blow to the pocket that many are feeling.

There’s so much information out there right now about this topic that it can be difficult to sift through everything, so here’s a summary of what’s changed, the impact this will have on the cost of living, and the helpful resources that are available to you.

What’s changing to the cost of living?

We have seen the price of fuel, food, and energy go up in quick succession and, unfortunately, the ad hoc mini budget, a.k.a. the Spring Statement, has not done much that will help to ease the worry that is quickly building across the country.

What are the increases?

There are several increases affecting everything from the price of fuel to the cost of food.

Over the last 12 months the Consumer Price Index (CPI) has shown an increase of 5.5%, that’s almost four times the increase we saw at the same time last year. Added to that, Retail Price Inflation hit 1.8%, the highest it’s been for over 10 years.

Food

The price of food and other goods have risen an average of 4.3% compared to the same time in 2021. This is the fastest price increase we have seen in the UK in 8 years.

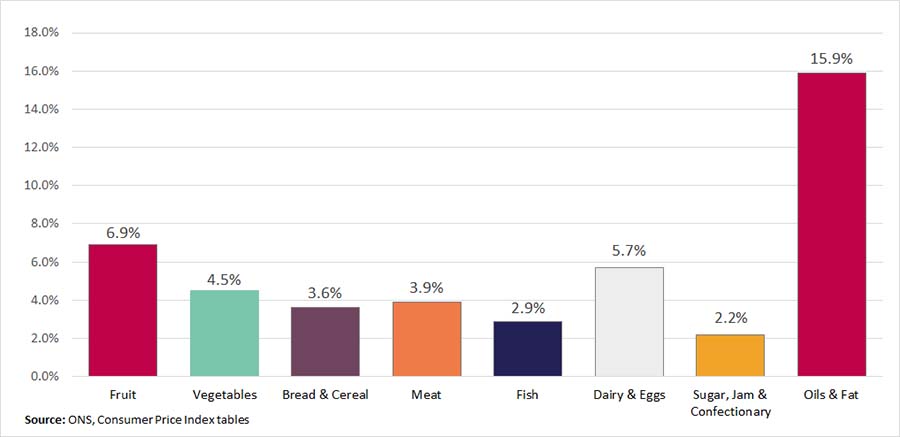

So, in the real world what does this mean for your weekly shop? As you can see from the chart below, this increase is affecting everything from confectionary at 2.2%, to oils and fats which have seen an increase of 15.9%.

The increases that we are seeing at present are on target to push the average household annual grocery bill up by £180.

If you want to help people who are struggling to afford their food shop and would like to volunteer, or if you are struggling and need to talk to someone, there are organisations that can help, like The Trussell Trust.

Looking for suggestions when it comes to preparing tasty meals on a budget? There are many free resources available online, including the BBC Goodfood website and Jack Monroe’s Cooking on a Bootstrap blog which is searchable and contains hundreds of budget-friendly recipes.

Fuel

The price of fuel fell considerably during the pandemic, but towards the end of 2021 there was a fuel shortage which pushed prices up again. This trend has continued and the average price of fuel per litre across the UK is £1.64 for petrol and £1.78 for diesel. This is a 45% increase on costs when compared to the same time in 2021.

This increase has affected not only the cost for commuters who drive to work, but has also had an effect on delivery truck availability, causing further problems with the supply chain.

If you want to save money on fuel then one option would be to take advantage of the over 60s free bus pass available through your local council. This provides you with access to free bus travel across England and Wales. If you're over 60 and live in London then you are eligible for a free Oyster Photocard which entitles you to free travel on the bus, underground and train within the city. Another option could be to share car journeys with friends and family, that way everyone is saving a little bit on the price of a single trip – and gives you someone to play travel games with too!

Energy Prices

In February 2022, Ofgem announced that they would be raising the price cap on energy bills by 54% due to a record increase in global gas prices over the last 6 months.

This means that, for many, they will see the annual price of their gas and electricity bills rise by between £693 and £708 per year. This price increase comes into force on the first of April and will affect an estimated 22 million households across the country.

Due to the rise in the cost of gas since the start of 2021, a total of 29 energy companies in the UK have closed their doors affecting almost 4.5million households.

While the increases are unavoidable, there are ways you can cut costs at home and make it more energy efficient without affecting your wellbeing.

If you do find that you struggle to pay the increased costs for your energy bills, your energy supplier has a responsibility to help you find a way to afford them, so, take advantage of the support they have available and contact your energy provider for support.

Did you know that some energy suppliers have a grant that they can award to help people to pay off outstanding bills? The Citizen’s Advice Bureau have more information on the utility companies that provide this particular grant.

Interest Rates

On the 17th of March 2022, the Bank of England announced that the Interest Rate was rising from 0.50% to 0.75% (a 50% increase). This is the highest level that they have been since March 2020. The increase has been made in an effort to tackle the rise in inflation, though the Bank of England has acknowledged that it will take time to have any effect.

An estimated 2 million households in the UK have a Standard Variable Rate (SVR) or Tracker Mortgage and these are the ones who are more likely to be affected by the higher interest rates. The interest rate is updated by the Bank of England every six weeks, so many mortgage holders will not see a difference for some time.

The BBC has an article that will help to simplify the interest rate increase and understand how this may affect you.

What help is available?

The combination of all these increases has affected every household. The Government has put a few measures in place that are meant to help people tackle the increased cost in living. This includes a £150 one-off payment made directly to you if you live in a property in Council Tax Band A-D. If you make council tax payments by direct debit then it will be paid to you automatically at the beginning of April.

If you would like more information about the help that is available to you, Age UK has done further research.

It’s important to ensure that you are receiving all the benefits that you are entitled to, these will vary depending on your individual circumstances, but include:

- Free bus pass

- Pension credit

- Housing benefit

- Winter fuel payment

- TV Licence concessions

- though you are no longer entitled to a free TV Licence if you are over 75 if you claim Pension Credit or are visually impaired you are entitled to concessions

- Council Tax support

- Council Tax discount

- if you live alone you are entitled to a 25% discount on your Council Tax

- Attendance Allowance

- Free health benefits

- prescriptions, optician’s appointments, NHS dental treatment

Where can I get advice?

If you have questions about the help available, financial concerns, or worries about the increased cost of living, here are a number of organisations that may be able to offer you support:

- Contact your local council

- Citizens Advice Bureau

- Money Helper

- Age UK

- StepChange

- The Debt Advice Foundation

What can I do next?

Are you concerned that your current property is costing you more than you can afford? With these new increases in the cost of living, you may be thinking about future costs and how moving to a different property could cost less to run.

Did you know that a property’s Energy Performance Certificate (EPC) rating indicates how energy efficient it is? So, if you dream of a new home, perhaps somewhere a little more fuel efficient, maybe less expensive to heat in the winter months, don’t forget that checking a property’s EPC when searching will save you money in the long run.

Searching for, and finding, a new home is exciting but can also feel a little overwhelming, especially in the current fast-paced seller’s market. If you’re over 60, Homewise is here to help.

Whether you’ve found your dream property and it’s over your budget, or you’re not sure where to start your search, get in touch with our team and we can help you to find your ideal property.

We provide people aged 60 and over with unique ways to boost their moving budget and transform their retirement with our Home for Life Plan.

A Home for Life Plan is a Lifetime Lease option that can be applied to the purchase of pretty much any property* in England and Wales, that’s on the market with any estate agent.

A Lifetime Lease can enable you to:

- Be secure for your lifetime without any monthly rent or mortgage payments

- Move to your perfect home complete with lower running costs

- Relocate to an area closer to friends and family with better public amenities

- Safeguard future inheritance or gift an early inheritance

- Be free from financial burdens such as outstanding mortgage or previous debts

- Create savings for the future and free up funds to enjoy your retirement

To find out how much Homewise could boost your budget by, try our online calculator! It's simple, quick and could provide you with a better understanding of your potential budget for your future home.

If you're selling a property to fund your move, you'll want a clear picture of its expected value to help you plan your onward purchase.

To find out what your property could be worth in the current market quickly and simply, get a FREE valuation using this independent online calculator.

Please note: all figures are correct as of 31/03/2022