On the 23rd of September 2022, Chancellor of the Exchequer, Kwasi Kwarteng announced a mini budget which included cuts to National Insurance, Income Tax (from April 2023), and Stamp Duty. This change to Stamp Duty is only related to properties on the market in England and Northern Ireland.

It’s believed that this adjustment will provide a boost to the property market, keeping it active while the country is experiencing a time of financial turbulence. Positively for those looking to put their property on the market, as recent figures from Nationwide show that the market is showing an upward trajectory and this latest change to Stamp Duty will help that to continue.

So, if you’re thinking of moving or are already in the process then the cut to Stamp Duty is fantastic news! Essentially you now have an increased moving budget or are able to create savings that you weren’t expecting.

Buying a new property is a big transaction and if you haven’t done it in a while then it’s easy to forget all the payments and procedures that are involved. Read on to learn exactly what these changes may mean to your move and how you can benefit right away.

What is Stamp Duty?

Essentially, Stamp Duty, also referred to as Stamp Duty Land Tax or SDLT, is the lump-sum tax that you must pay when you buy a property.

It works on a scale, and the rate you pay depends on the price of the property as well as whether it’s residential or commercial, if you are a business or an individual, if it’s your only property, and whether you are a first-time buyer or not (savings for first-time buyers have also been increased).

What has changed?

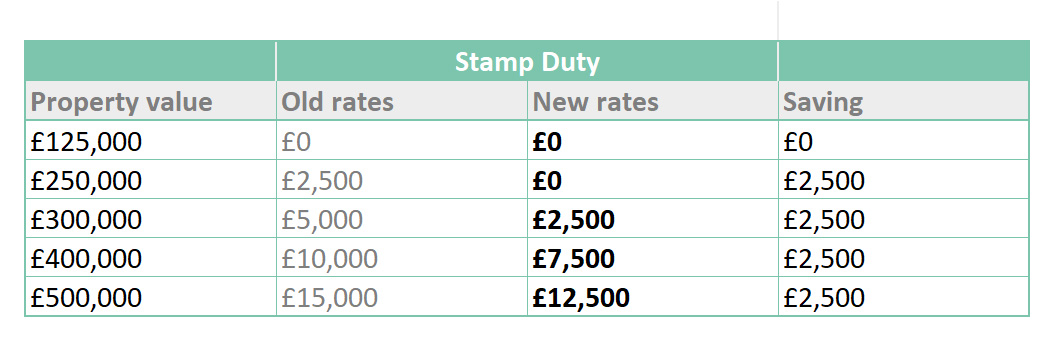

The threshold on Stamp Duty is being raised to homes costing up to £250,000. This means that you could now save up to £2,500 when you purchase a new home. This new cost structure is effective from the 23rd of September 2022, for property purchases in England and Northern Ireland.

Table source: HMRC

What does this mean for my move?

It can be easy to think that it won’t make much of a difference, but this change to Stamp Duty costs means that, if the property you’re considering has a value of more than £125,000, you could save up to £2,500 on your move.

This extra saving can make a big difference to your move. You could...

- Achieve your moving goals sooner

- Expand your search for the perfect property with an increased budget

- Sell quicker, being able to afford to accept a reduced offer

- Put aside more for savings, holidays, or make improvements in your new home

Want to know how much you’re going to save on your new property following the mini-budget? Visit the HMRC website for further details (including a calculator) on the savings available. This may be particularly useful if you are a first-time buyer or if this is your second home.

What if my property has already sold?

If you’ve sold your property but it has not yet completed then the good news is you’ll still be able to take advantage of the Stamp Duty cut, as it applies to sale completions on or after the 23rd of September 2022! What will you do with the extra cash?

What if my property is on the market?

Whilst there are no guarantees how long this cut will last (it's not a holiday like before), it is expected that this is a permanent change. So, whether you accept an offer today or in the future, you should still benefit from the change to the Stamp Duty threshold when your sale completes.

The great news is that with this change you could now look at finding a new home at a higher value or even be able to accept a lower offer for your property to sell quicker and still achieve your moving goals.

If you're property is struggling to sell, you may be making common selling mistakes that may be worth avoiding... You want your property to stand out from the crowd in the current competitive market, and ensure it doesn’t end up being missed in search results.

If you're not yet on the market, why wait? Even when you’ve found the perfect property and you’ve put in an offer, you’re still going to be a few months or more away from getting the keys. With the current cost of living increasing many are considering moving, so now is the perfect time to sell and find the ideal home for your future.

What next?

Having spent more than 50 years working in the property industry, we know there is no time to waste when the market is competitive.

If you're thinking about moving and are not sure of your budget, read our quick guide to help you work out your affordability.

Did you know, if you’re over 60, you could save thousands on pretty much any property available on the open market in England or Wales?

Our Home for Life Plan is exclusively available for those aged 60+ and can help you secure your ideal home for up to 59% less* than the market value!

With a Home for Life Plan, you could:

- Live in the home of your choice rent and mortgage-free

- Be secure in the property for your lifetime

- Free up funds for your retirement

Each plan is bespoke and designed to meet your individual needs and requirements. With the Stamp Duty saving and help from Homewise, your dream home could be within reach.

Why not try our quick online calculator for an instant, no-obligation estimate today!

Please note: All figures correct as at 03/10/2022